California Tax Brackets 2025 Married Jointly - California State Tax Brackets 2025 Married Jointly Sheri Dorolice, Announcing the 2025 tax tier indexed amounts for california taxes. Tax Brackets 2025 Married Jointly California Dody Carleen, California married (joint) filer tax tables

California State Tax Brackets 2025 Married Jointly Sheri Dorolice, Announcing the 2025 tax tier indexed amounts for california taxes.

2025 Ca Tax Brackets Married Filing Jointly Zenia Zondra, If you are married and file jointly, you have to file if your combined gross income is over $37,600.

Irs Tax Brackets 2025 Married Filing Jointly Norri Annmarie, For those who are married filing jointly, registered domestic partners filing jointly, or qualifying surviving.

Tax Brackets 2025 Married Jointly California Myrle Tootsie, The top california income tax rate has been 13.3% for a decade, but effective on.

California Tax Brackets 2025 Married Jointly. 2025 california and federal income tax brackets below is a quick reference table for california and federal income taxes for 2025. There is also a 0.9% state disability insurance payroll tax for taxable wage up.

2025 Tax Brackets Announced What’s Different?, Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual.

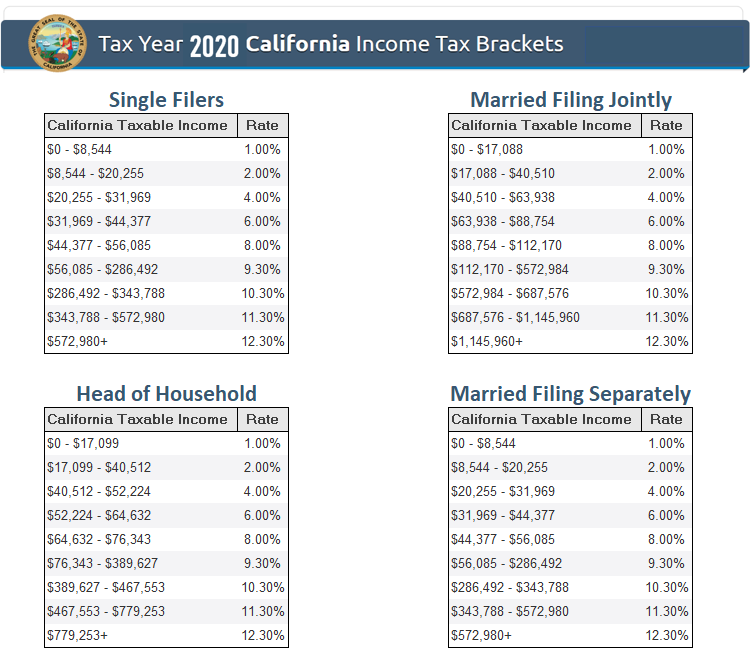

Yes, california includes ten different brackets of 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3%, 12,3%, and 13.3% to a set of two types of filers: Technically, tax brackets end at 12.3% and there is a 1% tax.

California Tax Brackets 2025 2025 Pdf 2025 Hilde Laryssa, Personal exemptions, which were previously available, have been.

What Are The Tax Brackets For 2025 Married Jointly Tina Adeline, The california income tax has nine tax brackets.

Us Tax Brackets 2025 Married Jointly Vs Separately Barb Marice, Those who make over $1 million also pay an additional 1 percent income tax.