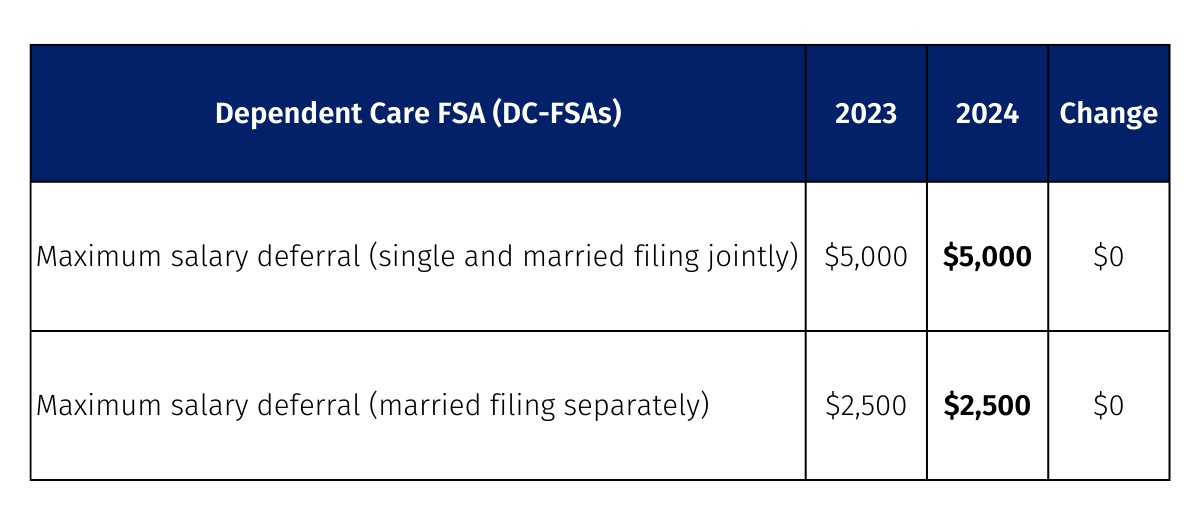

Dependent Care Fsa Contribution Limit 2025 - Fsa Guidelines 2025 Elyse Imogene, You must pay child and dependent care expenses so you (or your spouse if filing jointly) can work or look for work. You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for. Irs Dependent Care Fsa Limits 2025 Nissa Leland, That’s a $150 increase year over. On november 9, 2023, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

Fsa Guidelines 2025 Elyse Imogene, You must pay child and dependent care expenses so you (or your spouse if filing jointly) can work or look for work. You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, It remains at $5,000 per household or $2,500 if married, filing separately. On november 9, 2023, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

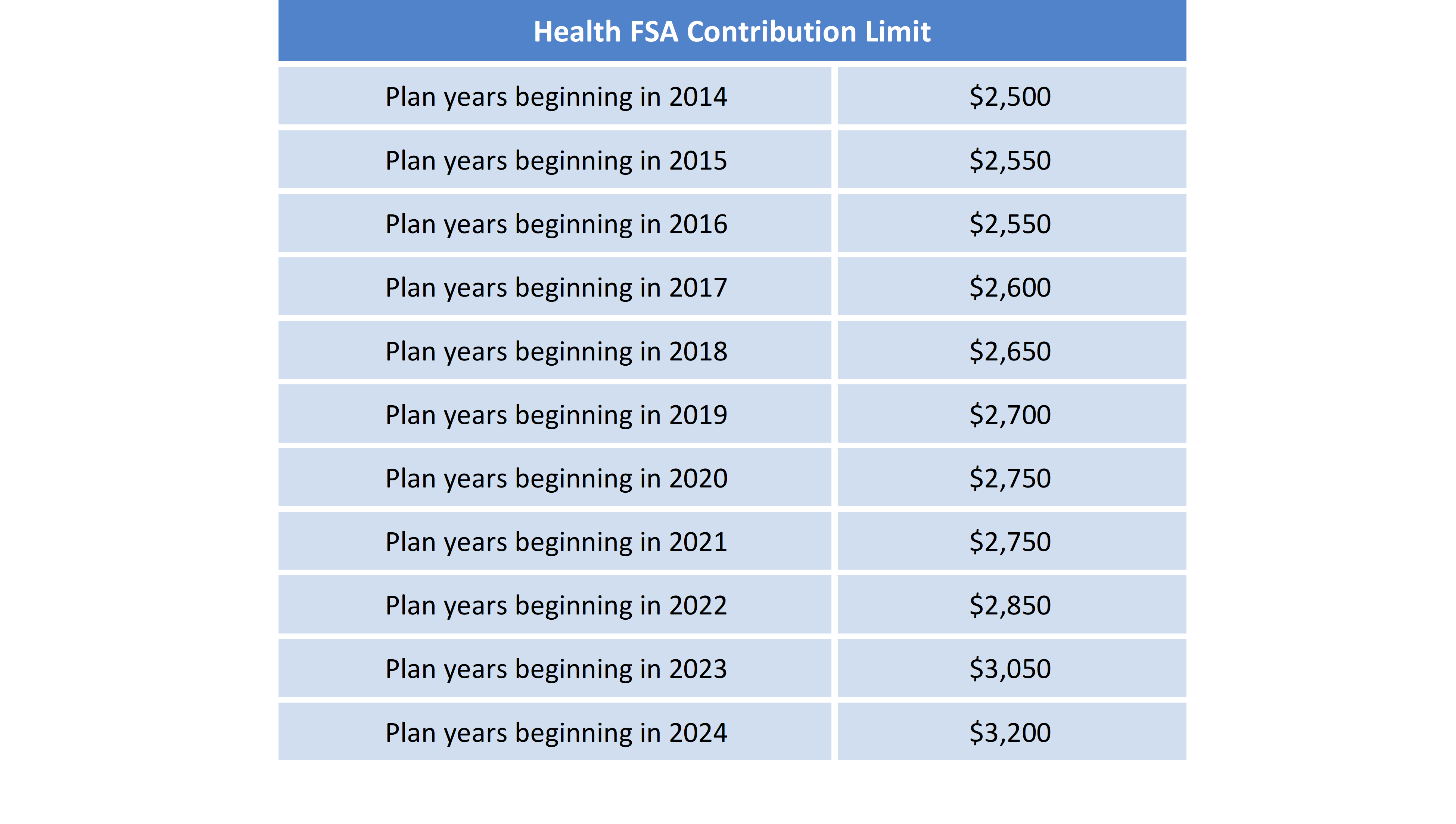

What You Need to Know About the Updated 2025 Health FSA Limit DSP, On november 9, 2023, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits. The annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2025 (up from $3,050 in 2023).

What is the 2025 dependent care fsa contribution limit?

Dependent Care Fsa Contribution Limit 2025. The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Under the Radar Tax Break for Working Parents The Dependent Care FSA, For 2025, there are new increased limits available for 2025 due to the secure 2.0 act. But for 2025, you can contribute up to $3,200 to a health fsa.

The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in.

New Contribution Limits for Retirement Plans, Health & Dependent, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Between august 1 and october 7, 2025 (fy25), you contribute $1,090 and receive intuit’s $650 employer contribution, which equals the irs limit of $5,000 for the 2025 calendar.

But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Join our short webinar to discover what kind of.

IRS increases FSA contribution limits in 2025; See how much, The annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2025 (up from $3,050 in 2023). Enroll in hcfsa, dcfsa or lex.

FSA Contribution Limits for 2025, Dependent care fsa contribution limit for 2025 once again, the 2025 dependent care fsa contribution limit will remain at $5,000 for single taxpayers and. For 2025, there are new increased limits available for 2025 due to the secure 2.0 act.

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.